The last balance sheet released by the Central bank of Cyprus confirms that the cypriot banking sector is under emergency liquidity assistance injection.

Last month, I suggested in this post that the Cypriot banks were out of collateral and thus had no choice but to tap extra liquidity from the central bank of Cyprus. This liquidity is usually provided under the emergency liquidity assistance scheme (ELA), by national central banks, with the agreement of the ECB’s council of governors.

Because the data released by the central banks are not always very clear neither detailed, it it sometimes hard to interpret the figures. In the case of Cyprus’ central bank, the balance sheet available on the bank’s website is very minimalist and therefore the presence of ELA in Cyprus was still unclear.

However, apparently due to an harmonisation of the data publication among the eurozone initially spotted by the FT, last Cyprus’ central bank balance sheet release is much clearer. In the document (available here), we can clearly notice a move of 3,8 bn euros from the “Other assets” item to “Other claims on euro area credit institutions”, which is apparently the item chosen by the ECB to unveil ELA refinancing operations. At least according to the Irish central bank’s last balance sheet, where a footnote states:

An accounting reclassification took place, in month ending 27 April 2012, in order to harmonise the disclosure of the Emergency Liquidity Assistance (ELA) provided by Eurosystem central banks to domestic credit institutions under other claims on euro area credit institutions denominated in euro.

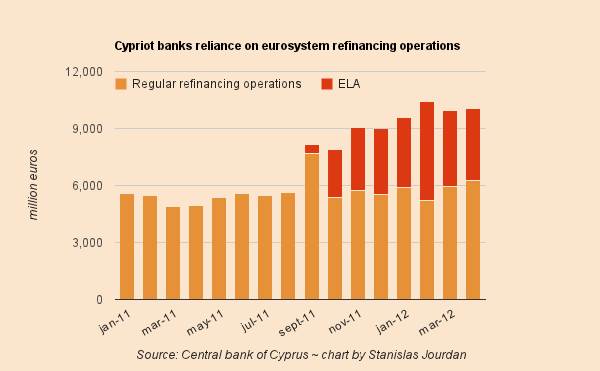

In other words, at end-april Cypriot banks were indeed benefitting from 3,8 bn euros of ELA. And I am now able to assume that such operations have been effective from september 2011 until now, to a level comprised between 2 and 5 bn euros.

A quick chart to sum up:

As always, the tricky question here is: are the cypriot banks illiquid or insolvent ?

One year ago, asked by Reuters whether the cypriot banking sector could be affected by a Greece default, Athanasios Orphanides, Governor of the Central Bank of Cyprus replied:

We have examined the situation and we have come to the conclusion that even though there is exposure in our banking system, that exposure is manageable because our banks are very well capitalized.

Sometimes central bankers can be wrong, too.

Tags: Cyprus, ECB, ELA

[…] We finally have some solid evidence to back up our guess work. The central bank of Cyprus’ latest balance sheet release includes €3.8bn marked as “other claims on euro area credit institutions denominated in euro” (a big h/t to Stanislas Jourdan at Boiling Frogs). […]

Hi, first of all amazing post, most in Cyprus had never noticed what you are writting. I was wondering if there is a way to calculate the sum of what the Central Bank of Cyprus has received from ELA

Thank you Constantinos,

the best way is to go to the Bank of Cyprus’ financial statement: http://www.centralbank.gov.cy/nqcontent.cfm?a_id=10458&lang=en

and check the line “Other claims on euro area credit institutions denominated in euro”. There you have the amount of ELA lent to the cypriot banks.

Thank you for your reply, I have to say I’ve learned more about the crisis in Cyprus reading your posts written a year ago than listening to all the exprterts talking on TV here…

thank you for this encouraging comment. Myself i learnt a lot about the crisis since i heard about ELA for the first time – when the Irish government bailed out their banks… This is key to understand how doomed is the current monetary system…

Dear Stanislas

Your invsetigation is very revealing!

Hello,

I have been reading your blog , mostly about my country, Cyprus, for a few months now. A friend of mine pointed to me an article of yours, about ELA, which then I had no clue.

It looks like that the world need journalists like you. In Cyprus the media learnt about ELA (the existence at least) last month – March 2013.

Very nice job!

Andros,

Your comment touches me right to the heart. This is exactly why i’m doing this and why i encourage people to do the same regardless of their ‘capacities’.

As Debtocracy’s filmmaker said once to me: “If people don’t take part in the production and release of information, they’ll never find someone within big media corporations willing to speak on their behalf.”

Thank you!