While the eurogroup welcomed Spain’s demand for a European aid to recapitalize its banking system, and guaranteed a commitment up to 100 bn euros, another solution could be put in place for recapitalizing the spanish banking system : the bail-in.

Resolving banking failures through the bail-in

June 11th, 2012 | by Stanislas Jourdan | published in Beyond the crisis, Crisis routine | Leave A Comment »

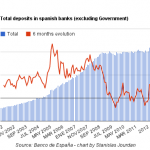

A run on the spanish banks?

May 21st, 2012 | by Stanislas Jourdan | published in Warning signs | Leave A Comment »

Is there a bank run on the Spanish banks? According to El Mundo, Bankia’s customers did withdraw 1bn euros on a single day last week (the information was then denied by spanish officials). True or not, these allegations are a good opportunity to have a look on the long-term evolution of the deposits in Spain.

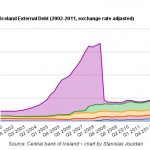

Can Spain do as Iceland did?

May 8th, 2012 | by Stanislas Jourdan | published in Beyond the crisis | 1 Comment »

The spanish governement is announcing a bailout plan for its private banks that could end up in injecting up to 10 bn of capital in Bankia. Of course, Spanish people are not very happy about that. On twitter, the hashtag #hagamoscomoIslandia (let’s do as Iceland did) is currently trending. But can Spain really do as Iceland […]

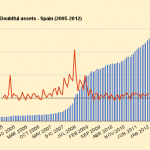

Spanish (undoubtful) fact of the day

April 18th, 2012 | by Stanislas Jourdan | published in Warning signs | Leave A Comment »

Today, the central bank of Spain published its monthly statistics on doubtful assets owned by its private banks. Doubtful assets are mainly composed of non-performing loans or arrears. In other words: money owed to banks that household or companies are possibly not going to pay back. Without surprise, the amount of these bad assets is still […]