While markets worry about a decline in house sales in France, millions of people are left behind, with no home or insalubrious ones. So what’s wrong with the French Housing market? It favors the rich in many ways.

Recent studies by the Fondation Abbé Pierre (pdf), demonstrate that at least 3.6 million people are badly housed in France, among which 685.000 are believed to be homeless.

It’s no secret why: with house prices skyrocketing by 260% in ten years (according to ECB data), houses in France are 50% overvalued by rent and 35% by income. Long story short, owning a house in France has become unaffordable for most people.

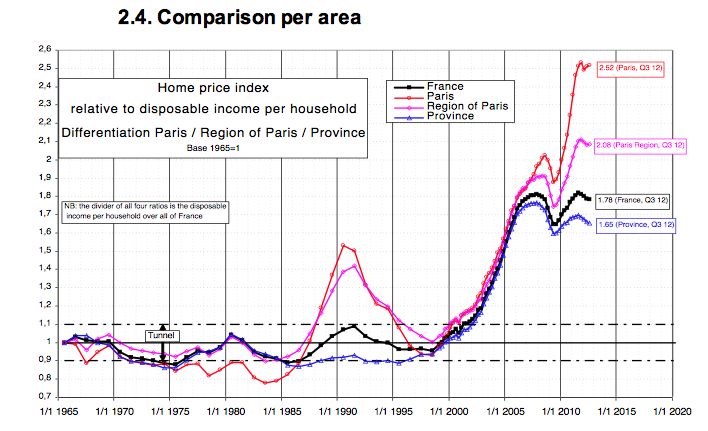

To illustrate this, let’s have a look this chart by the CGEDD, showing the evolution of housing prices in France relatively to the evolution of net income per household:

Several factors are to be blamed for this. Let’s explore some of them.

Failed government programs

First, because government housing programs fail. It is well known for instance that some people still benefit from “HLM” accommodations (government subsided houses) while not actually being particularly in need, disabling modest people to access them because of a opaque attribution system.

Moreover, public construction programs are being delayed by lots of cities – given penalties are less costly than building new homes.

Tax loopholes for the rich

Above all, previous governments introduced in 2003 a tax loophole on rental investment (known as “loi Robien“) which, on top of classical interest payment tax deductions, encouraged many people to invest in real estate. The law was even amended in 2008 (Scellier amendment) in order to ‘support’ the housing market after the crash of 2008.

The problem with these schemes is that they benefit to the richest: those capable of pledging collateral to a bank and get a cheap credit in return. These laws have encouraged many better-off people to invest into secondary houses, leaving modest people with fewer chance to access to ownership. Finally the poor have left with no other choice but to rent their homes to the rich who hoarded all houses with leveraged investment. And while those investors won’t pay much taxes, tenants are finally paying through their rents for the financial cost of these credits.

Jacobins’ heritage

Without any surprise, the situation in Paris (and surrounding areas) is particularly unacceptable. Here, the problem is partly due to a hyperconcentration of population living in a very small area, attracted by a concentration of money, powers, and jobs in the Parisian bay. In other words: jacobinism.

Along with restrictions on the height of building inside Paris, this situation creates a scarcity of homes in Paris. basically, Paris is a nightmare when it comes to renting a flat. Living in a 10m² studio for 500€, or queuing for an hour just for submitting an application to a homeowner are not uncommon situations.

Insurance requirements

And it’s not just a matter of money. The system is very unfair just because homeowner request very high guarantees (job contracts, deposits, guarantees…), and sometimes even illegal stuff like licence plates or medical certificates. As a consequence, even when you have the money it’s not easy to convince a owner to trust you that your situation is safe. If your guarantees are too weak (for instance you have a temporarily job contract, not the sacred “CDI” – unlimited job contract) then the insurance would charge extra costs to the owner – thus encouraging him to choose someone else. Obviously those who have better-off relatives on their back are privileged again.

Empty buildings

On top of all this, it’s no secret that many potential homes are left vacants. According to recent reports, more than two million properties are believed to be empty. Why such? Because these empty buildings (mostly offices), still are worth as assets in building societies’ balance sheets, thus ballooning their market value to the benefit of shareholders. Building societies also like to keep liquid assets in their accounts (ie. properties they can sell promptly if necessary), in order to improve their solvency – and please their creditors. To their defense, it is often costly to adapt from offices to housing.

This is why some claim for a tax on empty properties.

A bubble to burst

As you see, the French housing market is poisoned by an unfair system which benefit mostly the richest and perpetuate a scarcity of homes. In this regard, the housing bubble is indeed just a side-effect of ten years of systematically favoriting the rich, through government policies as well as a banking system designed for serving those who have the collateral.

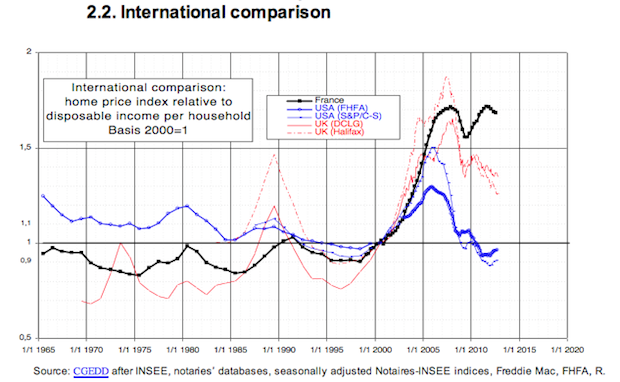

Of course, similar trends have been observed in many developed countries. But unlike its counterparts, France have seen no correction since 2008 in comparison with the UK and US. So far so good?

Tags: France, Housing, Inflation

Same situation in London.

Above illustrates clearly why we need an EU-wide land-value tax (LVT) aka site-value tax. LVT would curb: house-price inflation, profiteering, speculative land-banking, and tax shenanigans (avoidance & evasion) – land can’t be hidden or off-shored.

I also read somewhere that, once you get an apartment in a HLM, you keep it even if your revenue changes. The same source explained that this is done to mix people living in HLM: to prevent having just jobless and poor people in the same building. It may seems strange considering how many people are homeless but, at the same time, it’s not that stupid… Indeed, we all see and know how the bright idea of putting all the after-ww1 workforce in so-called “banlieues” ended up…

Second thing, the article doesn’t explain that when you buy an apartment using one of those numerous laws (Robien, Duflot, …), you always have constraints. For example, with Duflot law, as long as you get taxes deduction, the rent you can ask for is limited: in my city, it’s 9.88 euros per square meter per month. So, for a 33 sqm studio, you can’t ask for more than 326 euros/month. So these laws benefits to buyer but also to others as it provides quality housing (these laws only applies to new buildings) at low price. It also helps boost the new housing market…

About the Robien and Duflot laws it should be remembered that the rent is now so expansive …………..

Then , nobody can rent this housing

Then , nobody put money for buy this houses (except Raving Rabbids)

Mr Tristan don’t lie please

About your ” boost of the new housing market” i think it’s a bullshit :

For example this site hold by the french lobby of building construction say – 5%

for 2013 .

http://www.metiers-btp.fr/reperes/evolutions-du-btp/Pages/evolution-des-marches.aspx

Mr Tristan you’re better me in english language but ……… you’re a liar or ………..rich man ……………. or the both .

” It may seems strange considering how many people are homeless but, at the same time, it’s not that stupid… ”

Yeah, but it would be even better if the opposite was true, to mix poor people with riches where only riches are living…but that’s not the case. As a “rich”, you’ll be able to live in a HLM, but as a poor, you won’t find anything in the “richest” parts of cities or in the richest places in the country. Nothing affordable, neither for rent nor for sale.

For the Duflot law, you have to emphasize the fact that those rent limitations are there to make you benefit tax reductions. I mean, you can buy a lot of things with other systems (Scellier, Robien, Bouvard, Girardot…), you can buyt something without looking for tax reductions, and decide any amount for the rent… Only rich people can become owners, a lot of them don’t need tax reductions.

And yes, there are plenty of offices, empty offices, useful for balance sheets, but that’s all…