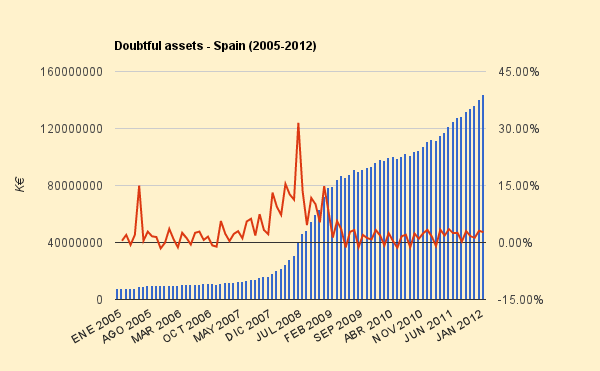

Today, the central bank of Spain published its monthly statistics on doubtful assets owned by its private banks. Doubtful assets are mainly composed of non-performing loans or arrears. In other words: money owed to banks that household or companies are possibly not going to pay back. Without surprise, the amount of these bad assets is still rising.

In february, theses assets rose by 3 little billions making the total amount peak at 143 bn euros. This represent about 8,15% of the total assets of spanish banks and is a 17-year high for Spain.

Here is a little chart made by myself:

These 143 bn are potentially a big black hole for the spanish economy. While the government is planning on a 56bn restructuration of the banking system, much more money could be actually needed to fill the gap.

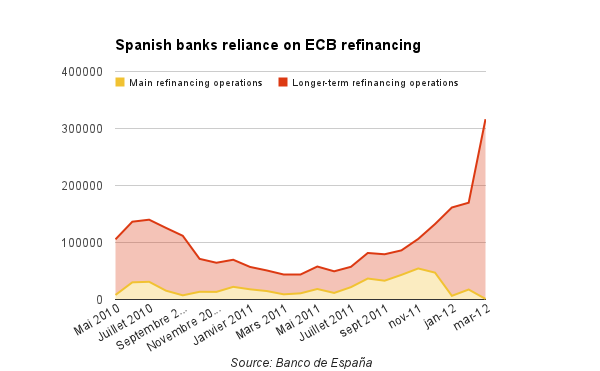

No wonder why, at the same time, ECB lendings are rising so much, as the following chart (in million €) illustrates:

I let you imagine what could mean more austerity for Spain…

Tags: Doubtful assets, Spain

Your Comments