Being busy with my projects, I’m not posting very much these days. So here is a quick roundup of warning signs I’m looking in my radar.

ECB refinancing operations have never been so large

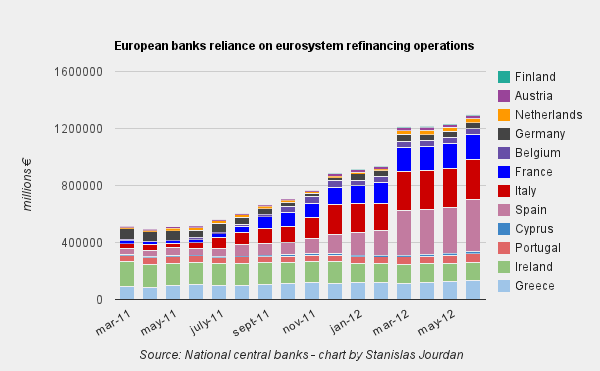

Not very surprisingly, european banks are more and more relying on the ECB to achieve their funding needs. At end june, total refinancing operations (including emergency liquidity assistance -ELA) peaked at 1.290 trillion euros, a new record. As my home-made chart shows below, we can clearly see a new bump in the use of these funding tools in june. Should we conclude that the two LTRO operations conducted in december and february were not enough?

The case of Spain, Cyprus, Portgual and Greece are particularly worrisome:

- Spain: ECB refinancing operations now peak at 365 bn euros (new record), with a jump of 44bn last month

- Cyprus: I already noted that the central bank had been using its ELA weapon to refinance the cypriot banks. Since then, the outstanding ELA have been rising to 8bn euros at end-june (40% of Cyprus’ GDP!), from 5.6bn euros in may.

- Portugal: new high record at 60.5bn euros

- Greece: new record at 135bn euros refinanced through the ECB operations and the Bank of Greece’s ELA which now reaches 62bn euros.

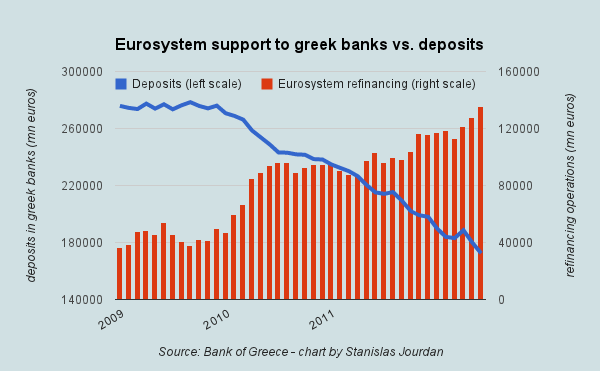

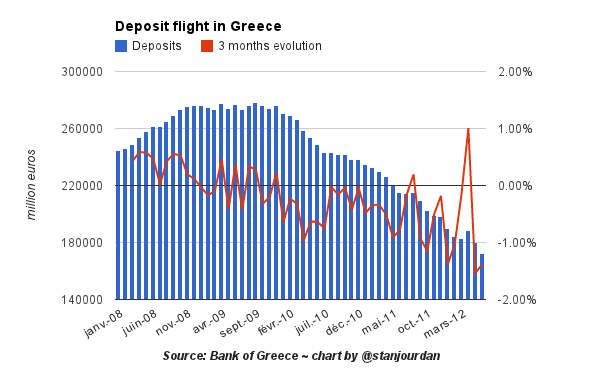

Greece: endless deposit flight

Let’s stay in Greece and have a closer look on the deposit flight affecting the banking system. As we can see, overall deposits (excluding government) reached a low-record of 172 bn euros from 240 bn pre-crisis.

If we look at the month-to-month evolution, we can clearly notice the accelerating trend of the outflow in the last two months:

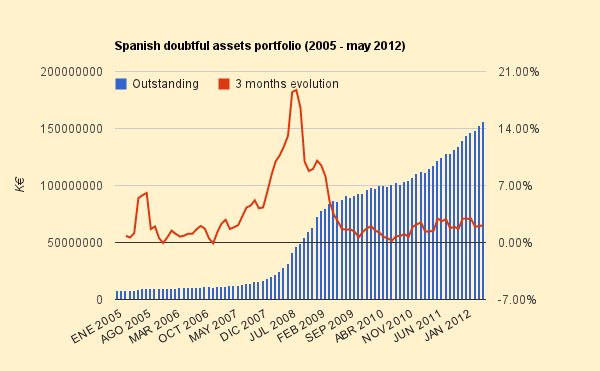

Spain: doubtful loans still increasing

Last data release by the Bank of Spain reveal a new leap of non-performing loans to 155.8bn euros from 152.7bn. This follows the trend of a +2% annual growth since last summer. A chart:

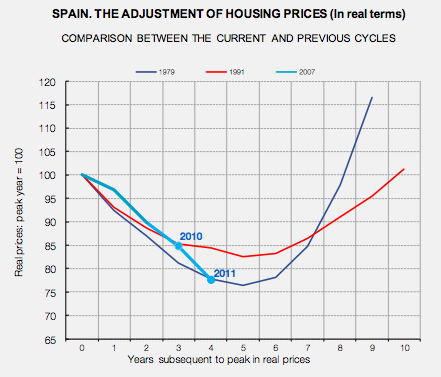

Doubtful loans now represent 15.6% of all secured loans issued by spanish banks. A big bad black hole, that will most likely not decrease as unemployment keep on rising and people go bankrupt… and real estate market go down. Come to think of it, this chart from the Bank of Spain is no much reassuring either:

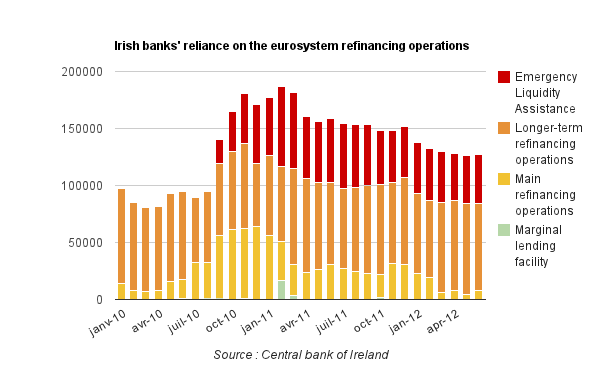

Nope, Ireland is not getting (much) better

Ireland is back in the sovereign bond market, but don’t get fooled: the country is still a long way to go before any sort of recover. Just a few facts to keep in mind:

- While decelerating, deposits are still outflowing the country : -0,9% on the last 6 months. We are far from a complete stabilization.

- Mortgages in arrear (ie. not being repaid) are still increasing and represent more than 10% of all mortgage loans. And you thought the bubble was over?

- In 2012 alone, the Irish government (ie. taxpayers) have to repay 19bn euros to the private investors of the bankrupt zombie banks nationalized during the crisis. In other words, the bank crisis is far from over and creates a huge redistribution of wealth from the taxpayers to foreign investors, private savers, and others vulture funds. This will not help any domestic growth…

- Irish banks are still heavily relying on the ECB and ELA operations to achieve their fundings (cf chart below). This means confidence in the banking system has not been restored, despite huge recapitalization with public funds.

I surely missed other stuff! Please comment below if you have any clew to share.

Tags: ECB, ELA, euro crisis

Your Comments